During your stay in Poland you may be required to provide a certificate of no tax arrears to prove you don’t have any unpaid taxes. You may get this document by visiting a tax office, but there is an easier way too get this document.

Getting an access to the ePUAP system.

As with many other matters at Polish government offices, you can get this done without leaving your home. This is possible in an Internet ePUAP system.

It should come as no surprise, that in order to use ePUAP to get a certificate of no tax arrears, you need to first be able to access this system. You can learn more about this in our article here:

Having ePUAP access, you can then log in and apply for the document.

A step-by-step guide of getting a certificate of no tax arrears through ePUAP.

- First, go to: https://www.biznes.gov.pl/pl/opisy-procedur/-/proc/751 and then choose “Złóż wniosek elektronicznie”.

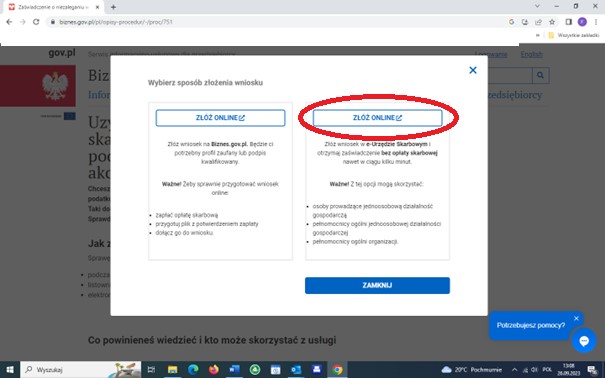

2. Then, the website will show you two ways for obtaining certificate – you should choose applying for the document by e-Tax Office, as marked on the picture below.

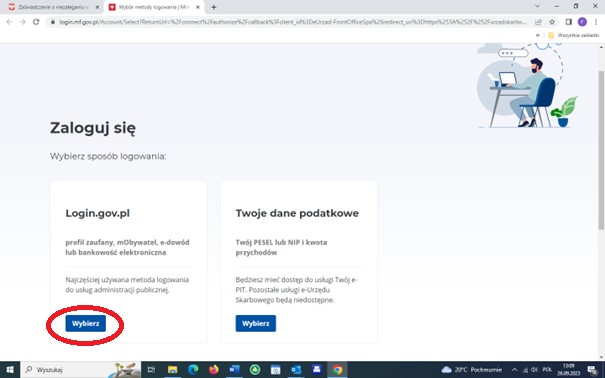

Biznes.gov.pl will redirect you to log in page. You can choose how to log in to e-Tax Office – choose “login.gov.pl” option, it will allow you to log in by Trusted Profile.

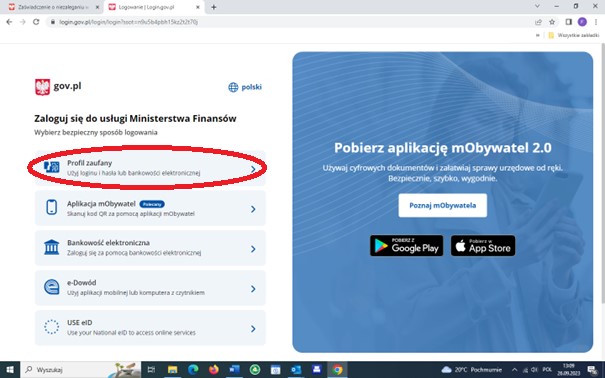

On the next page, you should choose “Profil Zaufany” as one of the methods of logging in.

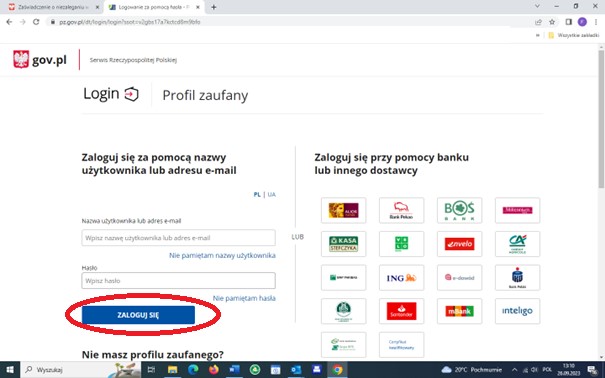

You will be redirected to Trusted Profile page, where you can log in either with your Trusted Profile login and password (left side) or use your Internet bank account log-in method (right side):

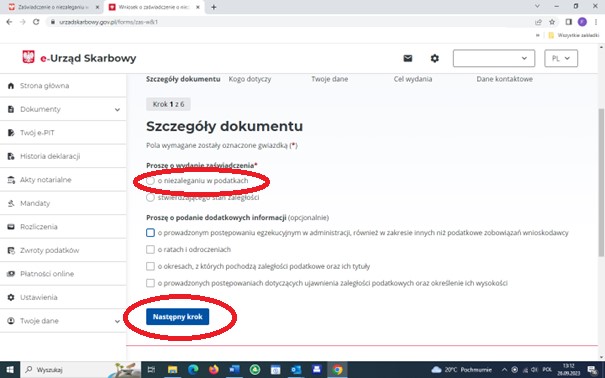

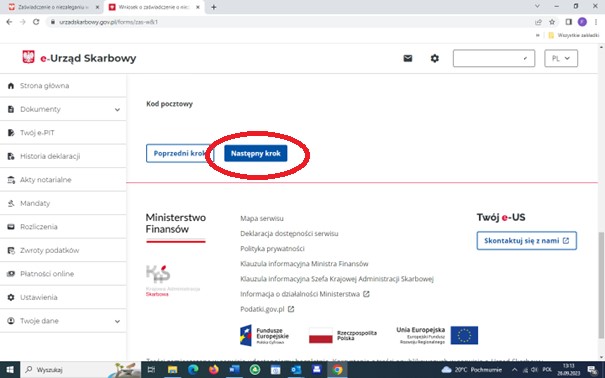

After logging in, you will be redirected to e-Tax Office page. You have to tick first option “o niezaleganiu w podatkach”, so the document will refer to your taxes. After that, you should click on blue button “Następny krok” (that’s everything you have to do on this page).

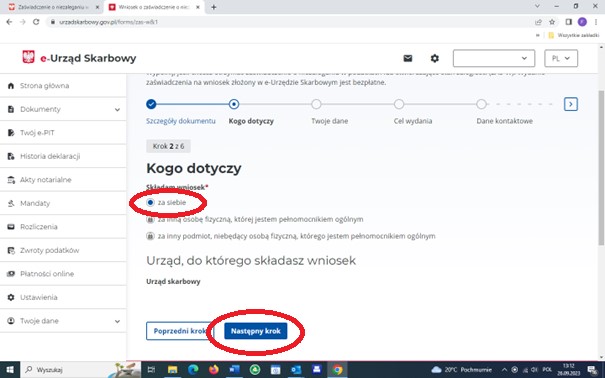

On next page, you should indicate for who you are applying for certificate – for you, for other person as her/his proxy or for other entity as its proxy. Page will show you to which Tax Office application will be send. Then click “Następny krok”.

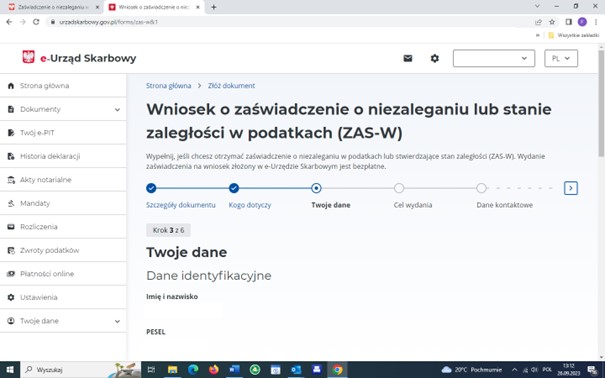

Then, website will show you your data – you can check if they are correct and then click “Następny krok”.

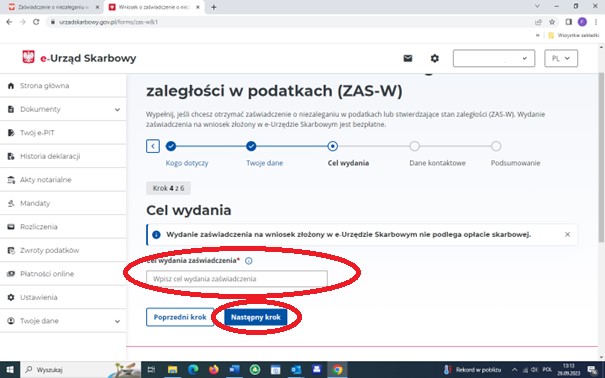

After checking your data, you will have to indicate the reason why you need certificate regarding no arrears in taxes and then click “Następny krok”.

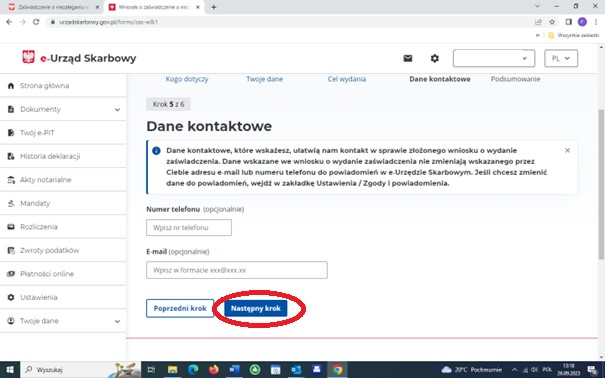

Then, you can indicate your e-mail or phone number in case Tax Office will need to contact you, but it’s not obligatory, and click “Następny krok”.

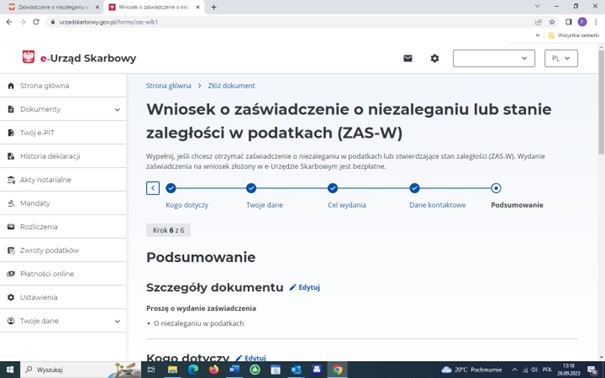

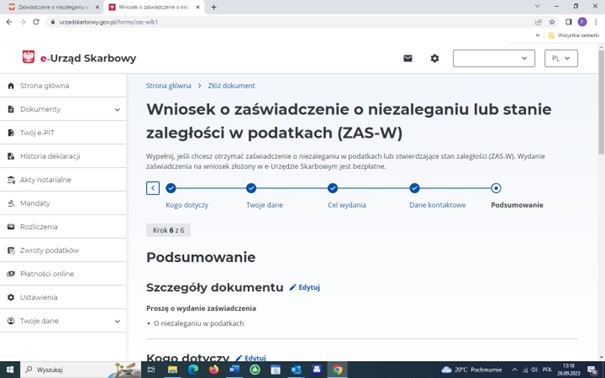

On next page, website will show you summary of the application. If everything is correct, you should choose blue button “Akceptuj i wyślij” (“Accept and send”). You can as well choose “Podgląd” (“Preview”) in order to see application, or choose “Rezygnuj” (“Resign”) if you don’t want to submit this application.

Would you like to know more? Do you need legal assistance in Poland?

Feel free to contact us and take advantage of our services.